Engystol — a medicine, manufactured by Heel, for the complex treatment of flu and other viral diseases. It appeared in the late 30s of the twentieth century and was first registered in Ukraine in 1993.

Now Engystol is represented in 11 countries of the world. It is the No. 2 product in the world (according to Heel Universe) in the segment of medicines of natural origin. The growth rate is 55% in monetary terms and 40% in physical terms. Today — in the TOP-3 drug brands in Digital for the 1st half of 2021 (according to apteka.ua).

We tell how we achieved sales growth thanks to a flexible advertising campaign for the product in the context of COVID-19.

Brand’s challenges and objectives

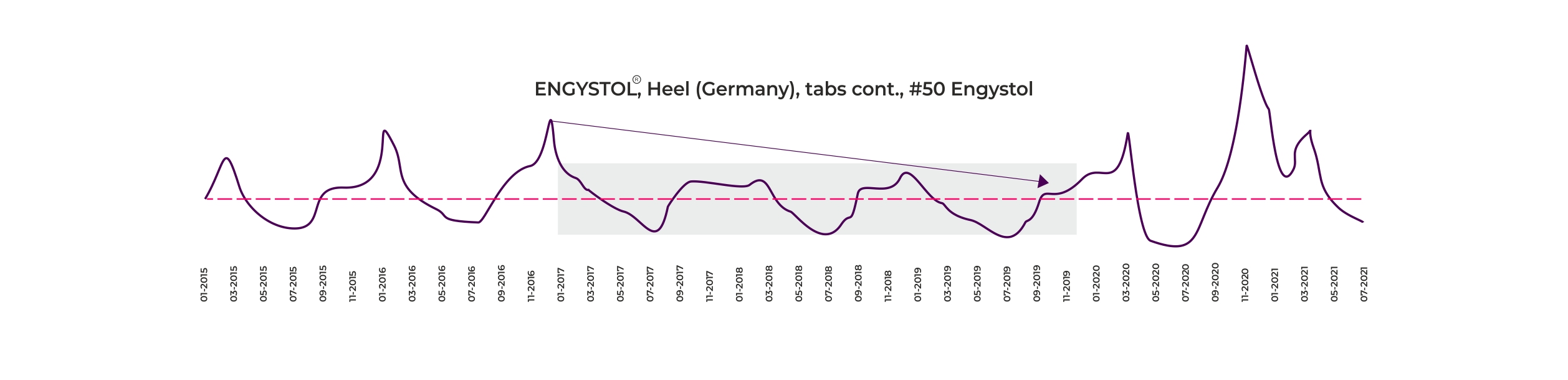

In 2017-2019, Engystol sales decreased by an average of 12% in real terms. More players joined the stagnating market. The available budget for promotion (compared to other brands) was significantly lower. The level of awareness of the drug was low.

Objectives:

- New positioning of the medication on the market.

- New communication strategy (adaptive).

- An increase of awareness level of the medication

- An increase in sales in real terms by 30%.

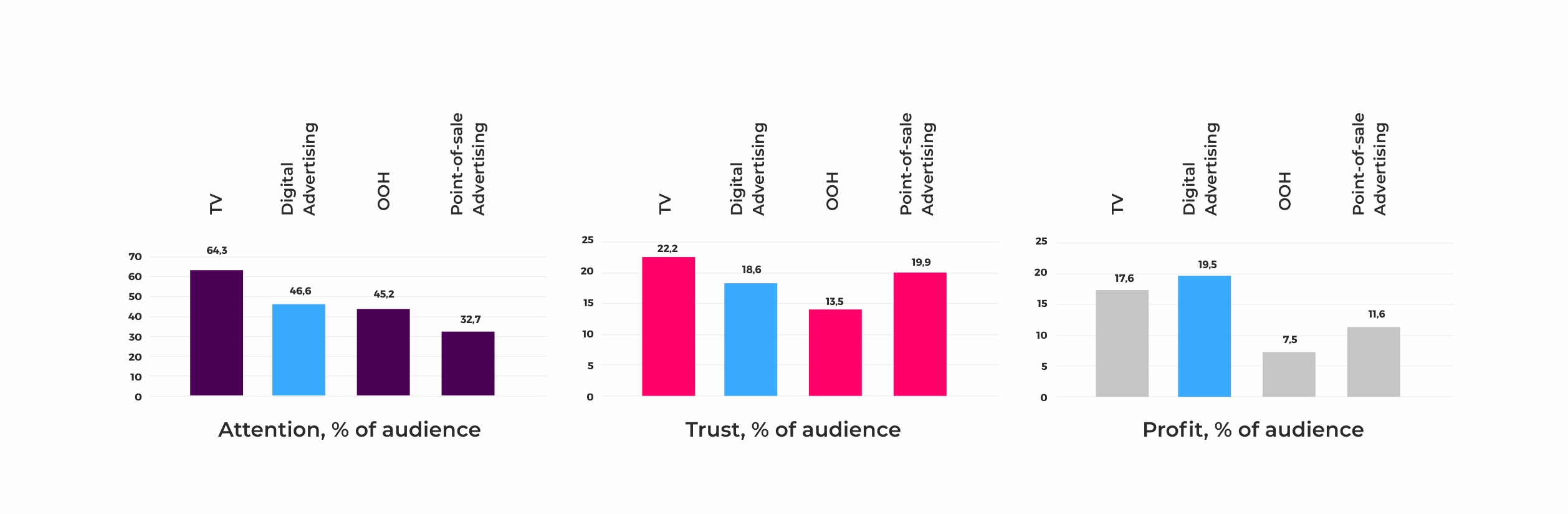

Among the channels that attract the most attention of the target audience and inspire confidence, the Internet occupies a leading position. Therefore, we have chosen Digital as the main channel of communication with the target audience.

Objectives and challenges of the advertising campaign

We needed to increase sales and market share of Engystol. Besides, we had to shift the focus away from the competitors.

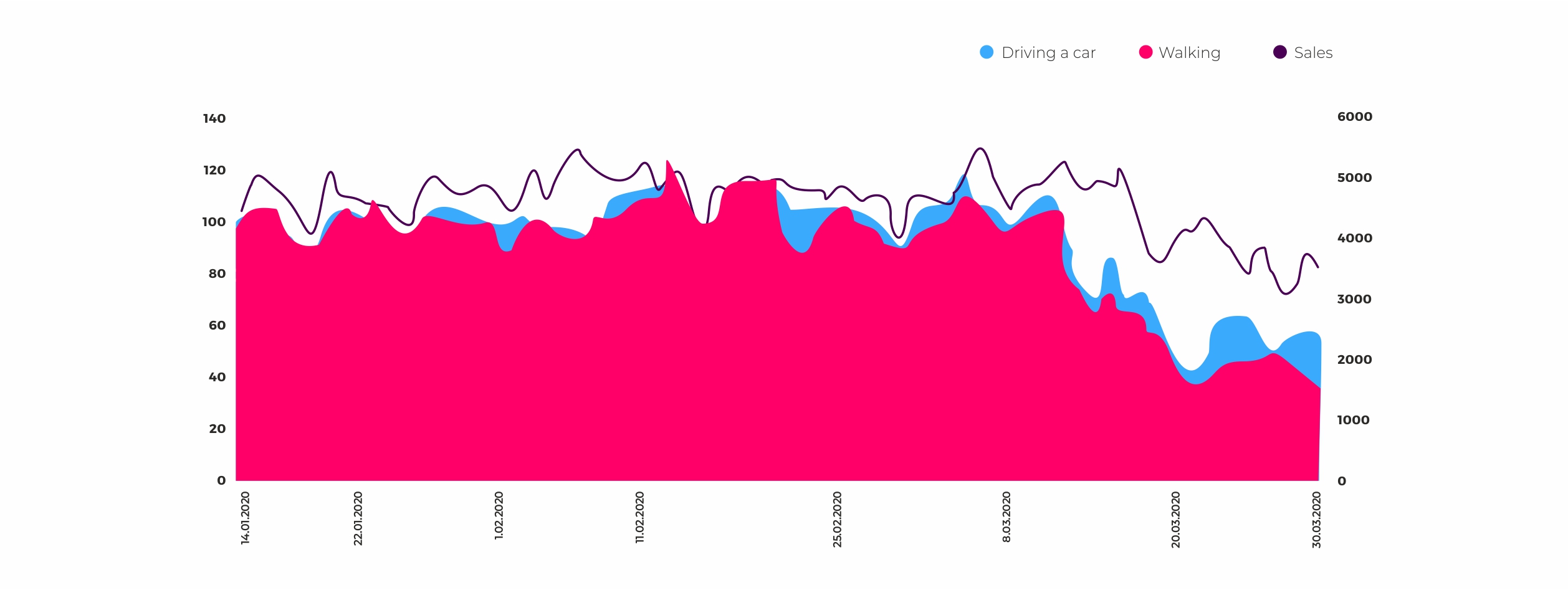

Among the challenges is the high level of advertising activity in the cold medicine market. This level is maintained constantly, in all channels, including television. In addition, Covid-19 has changed the media consumption of the target audience. The online and offline activity of users has changed, there has been a change in priorities in the consumer basket.

During the first lockdown, people took to the streets less, while reducing the risk of infection. The level of public anxiety has increased. As a result, the level of sales has decreased.

Competitor analysis

We analyzed the advertising activity of competitors and identified the media mix of categories, the seasonality of communication, and advertising tools that are often used in Digital.

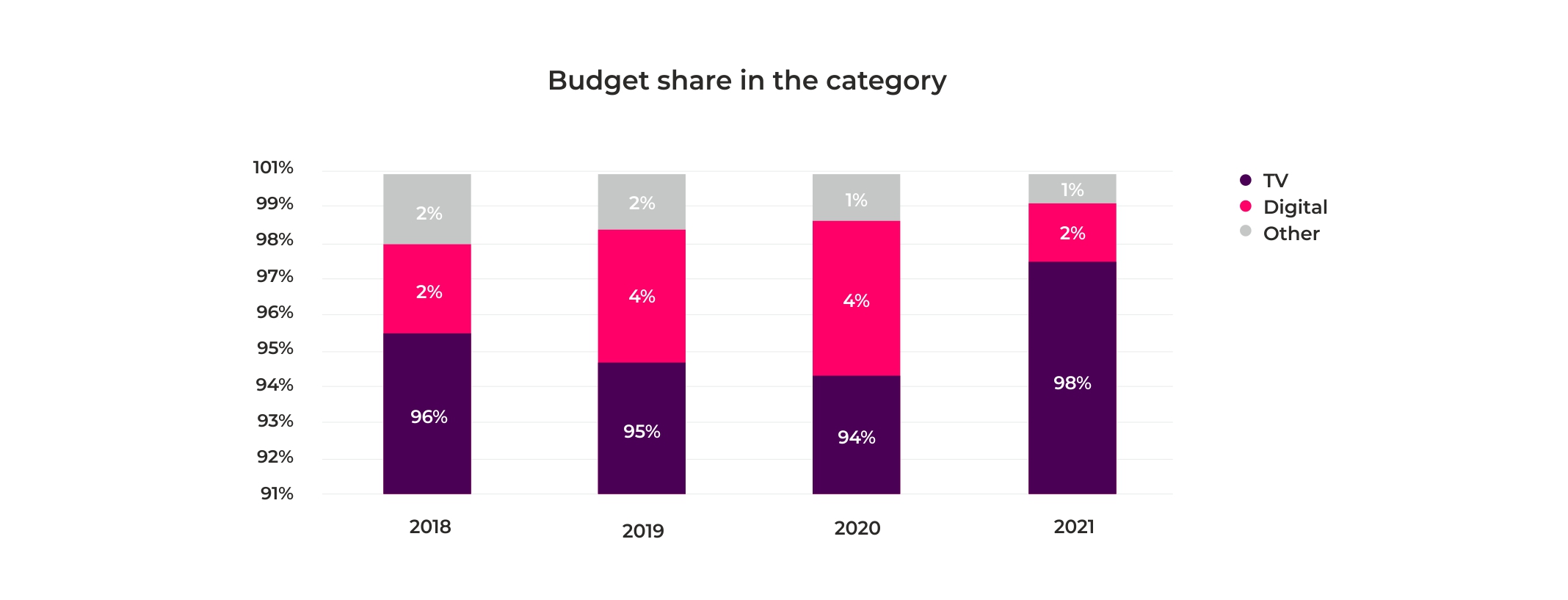

We found out that TV placements are the main communication channel for category brands. Digital has a supportive role.

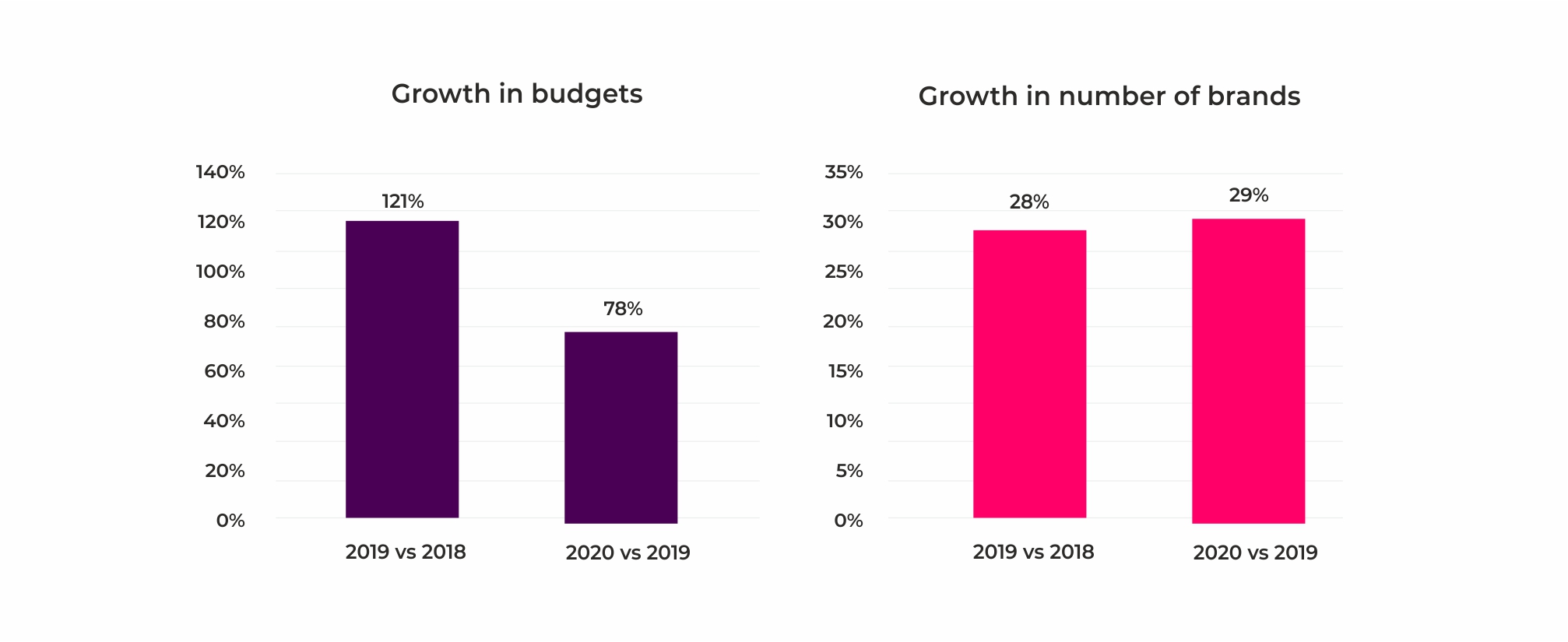

Brand activity in Digital grew both in volume and in the number of active brands.

There was a clear seasonality of advertising activity — January-April, September-December. Communication corresponded to the high season of consumption. Communication took place mainly in the video format in Digital, so it became harder to fight for the attention of the audience.

The main consumer profile of the category is predominantly women aged 25+. But, according to the advertising activity of brands, we noticed that competitors were focusing on an audience of 25-45-year-olds.

We analyzed our target audience, and the target audience of competitors in terms of sociodemographic parameters and identified the main touchpoints where the consumer comes into contact with the “category” or with our product.

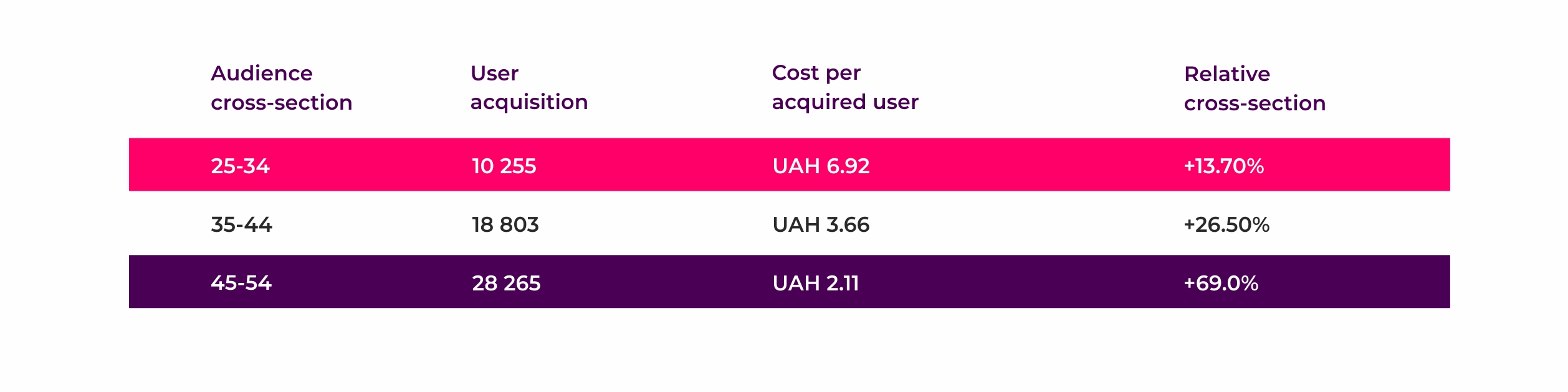

We came to the conclusion that the consumption of Engystol is lower compared to competitors in some regions. It also turned out that a third of buyers and consumers of immunostimulating and anti-cold drugs were over 45 years old, and competitors in communication in Digital focused on an audience of 25-45. The Brand Lift study confirmed the hypothesis of an increase in the age of communication. The 45-54 age group showed the greatest increase in ad recall.

To launch an advertising campaign, we had to:

- Expand the TA profile of Central Asia, covering the cities of 100-500 thousand residents.

- Extend the age of communication to 60 years old, adding an additional 3.16 million users.

- Within the regional distribution, apply adaptive targeting based on Covid incidence data and potential audience capacity.

We understood that quarantine would continue for a long time, and the incidence rate would change. Therefore, as cities were added to the red zone, we connected/strengthened communication in this city.

Media consumption of the target audience

We analyzed media consumption and determined that every day the audience communicates in instant messengers and email, searches for information on the Internet, consumes content on social networks, and watches videos.

To reach the majority of the target audience, it was necessary to use targeted advertising on social networks, video resources, and search advertising, while working with generated demand. In order to work with other goals, programmatic solutions were used.

Advertising approach

We needed to increase the level of consideration and consumption of the medicine. Given that:

- The advertising activity of the category and the number of active brands increased.

- Competitors prefer communication in conspicuous formats.

- The interests of different age groups of the target audience on the Internet differ.

We planned:

- Volumes, formats, and channels will allow you to stand out from the competition.

- Channels with a large number of the target audience.

- Tools with the ability to quickly change targeting settings.

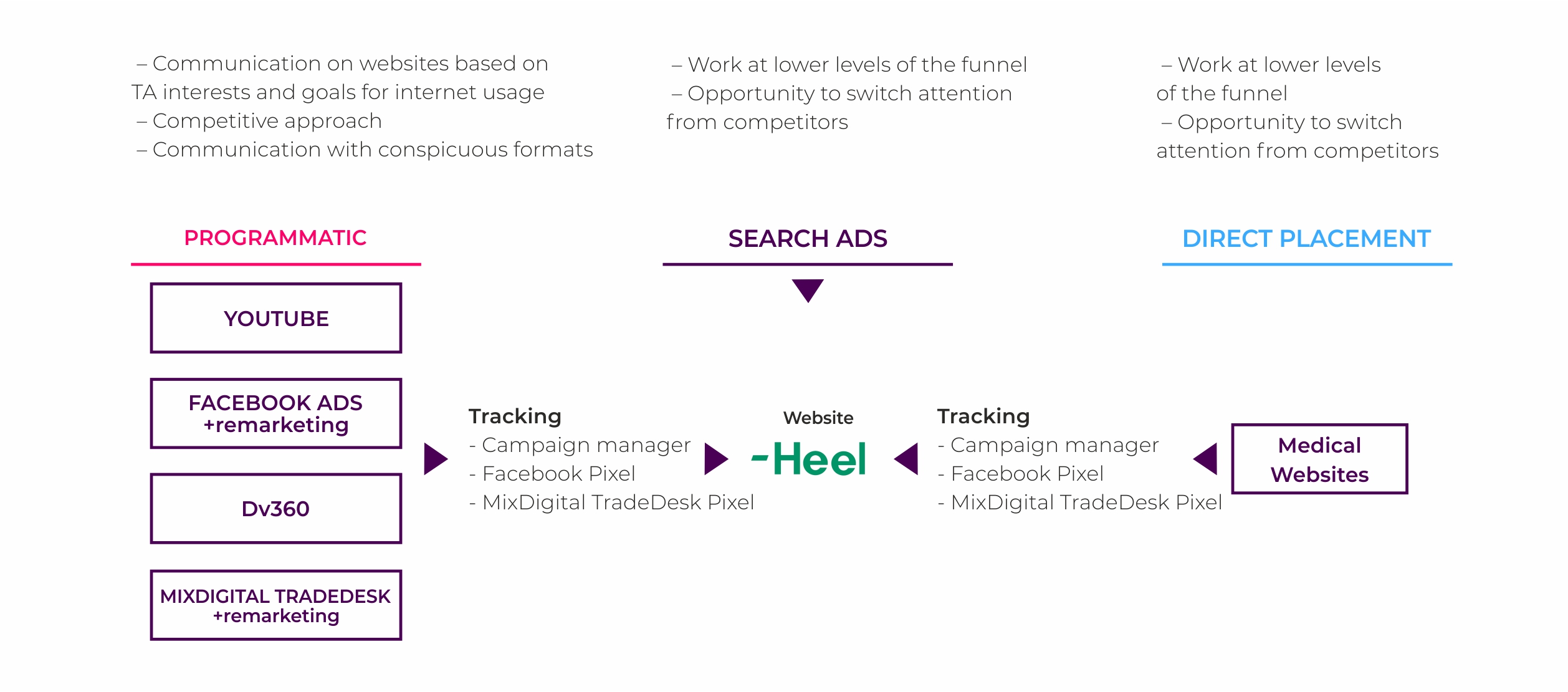

At the same time, we focused on the channels used in the lower levels of the funnel — we worked with formed demand. We used a large share of programmatic solutions in the media mix, which would allow targeting specific target audience segments.

We divided the stages of communication into:

- Flight-based. The main task was to reach the maximum audience and convey the key message.

- Constant. The main task was to work with the generated demand. People get sick throughout the year, so you need to work with demand all year round, and not just during periods of “active advertising flights”.

The split of formats and tools:

- We allocated the main budget for the purchase of advertising impressions using Programmatic in Display & Video 360 and TradeDesk; YouTube for video communication, Facebook Ads.

- To work with the generated demand, we used advertising on Google Search and direct placements on pharmaceutical sites.

- Retargeting: The category has a number of restrictions for retargeting. For repeated communication, we needed TradeDesk and Facebook Ads.

The Heel website has a high level of traffic, both organic and paid. We collected significant audience segments with which we could re-communicate, thereby increasing the frequency of contact. To do this, we used retargeting in the TradeDesk and Facebook Ads tools.

Period and ecosystem of communication:

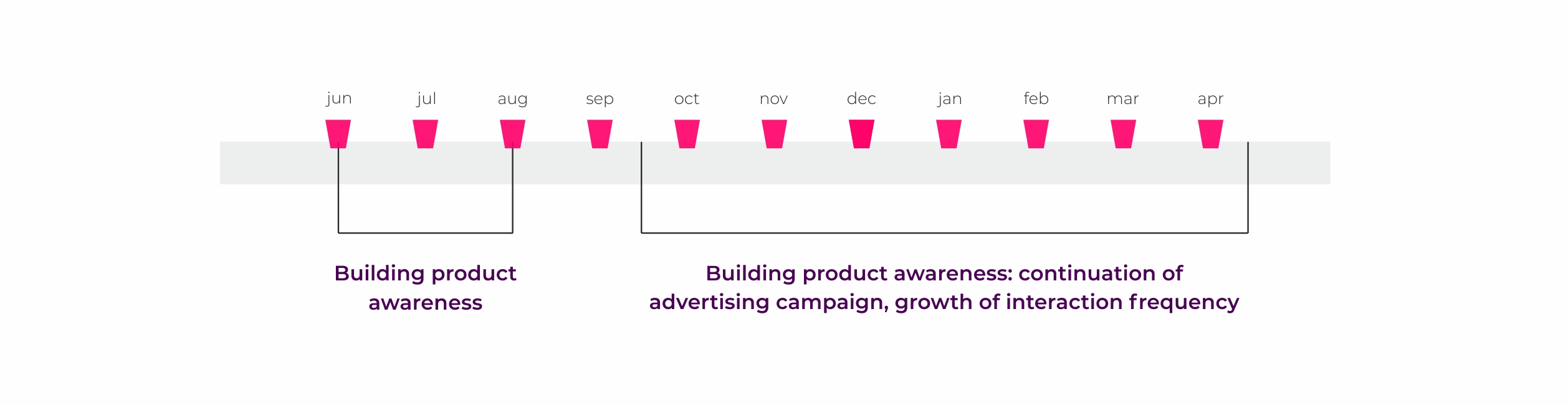

We used an early communication approach: we have been building awareness about the medicine from the summer when the space is free from competitors. During the high season, we continued the advertising campaign, increasing the frequency of contact. As a result, the audience already knew about the product by the high season.

Communications Ecosystem

Campaign optimization

You can’t launch a campaign and leave it alone. Without taking into account the situation on the market, and how users perceive the brand, we will lose money. Therefore, we have optimized the campaign:

- GEO optimization. Strengthening communication in regions that moved into the orange or red zone.

- Working with ad placements. During the lockdown, people read the news more, so we strengthened communication on top news sources with noticeable formats (branding).

- BrandLilft study — we measured the effectiveness of creatives in terms of ad recall for different target audience segments.

- We re-split the amount of search advertising for different groups of keywords — the main focus was on category and brand queries.

Advertising Campaign Results

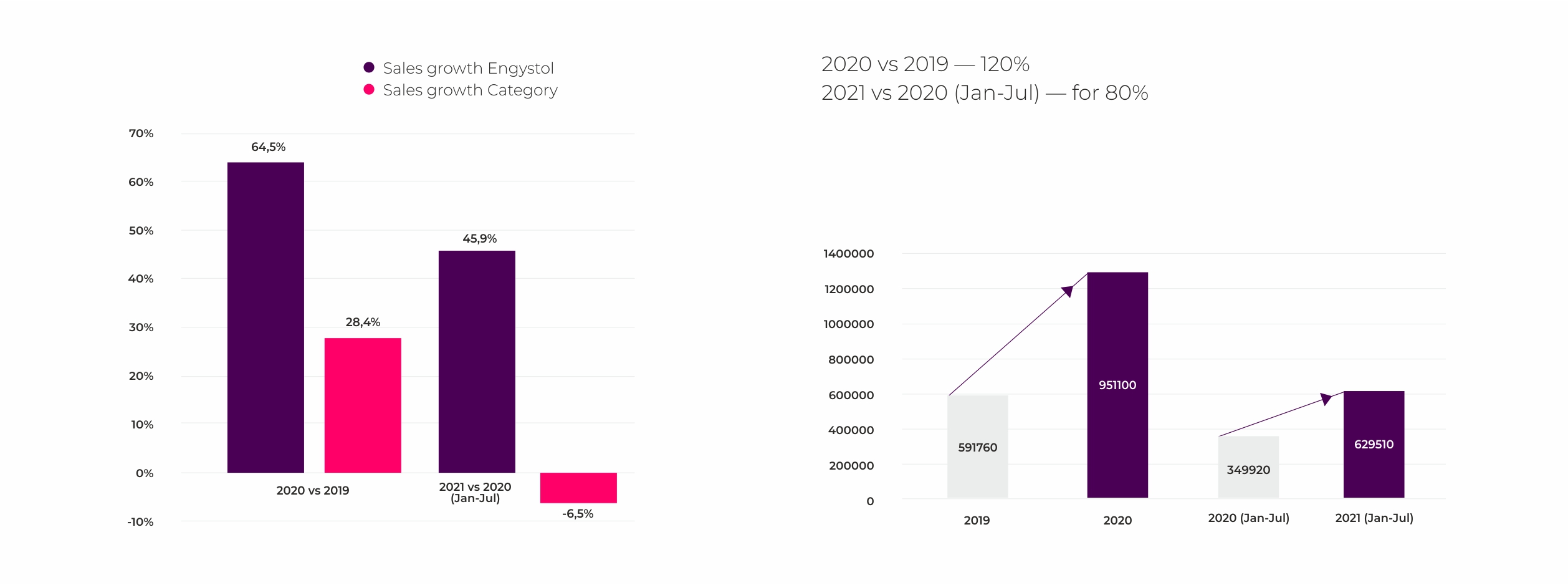

As a result, Engystol’s sales increased by 64.5% in 2020 compared to 2019, and by 45.9% in 2021. The number of search queries related to the medicine increased by 120% in 2020, and by 80% in 2021.